Let’s get one thing out of the way.

Most financial firms know they shouldn’t lean too hard on jargon.

Nobody is out here trying to win hearts with “synergistic disintermediation” or “bespoke portfolio optimisation”.

So why is it still a problem?

Because modern jargon isn’t always complex. It’s familiar. It sounds sensible, safe… and dead boring.

Think about how many fintechs promise “seamless onboarding”, “smart automation” or “real-time insights”. No one’s lost in a fog of confusion, but they’ve stopped listening.

Because those words don’t say anything. Or rather, they say exactly what everyone else is saying.

And that’s the real danger.

Jargon doesn’t just kill clarity.

It kills distinction.

The vanishing brand

There’s a cognitive bias called “semantic satiation”. It’s when a word or phrase is repeated so often that it temporarily loses meaning.

Now apply that to your homepage. Your product deck. Your investor update.

When every firm “powers growth” or “enables digital transformation”, your message stops meaning anything at all.

You’re not misunderstood. You’re forgettable.

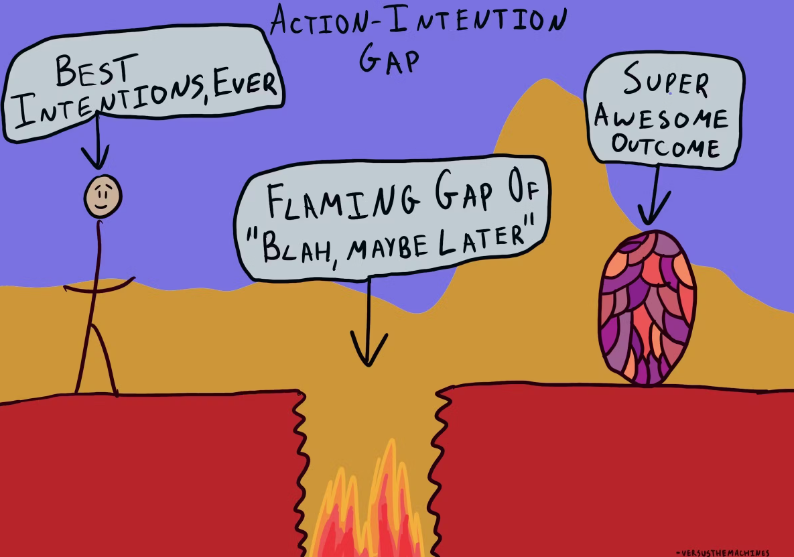

This is where most finance brands, who think they’re avoiding ‘jargon’, fall into the trap. They swap out the old-school technical speak but replace it with safe, recycled abstractions.

They end up with what’s known as “blandification”.

Just look at these actual taglines from real financial firms:

- “Empowering your world.”

- “The future of finance is here.”

- “Redefining simple.”

So, what should you write instead?

Not just simpler words.

More concrete ones. More specific ones. More ownable ones.

Here’s what I mean:

1. Instead of “end-to-end solution”, try “from onboarding to reporting, all in one place”.

2. Instead of “real-time insights”, try “you’ll see the data before your inbox does”.

3. Instead of “empowering users”, try “gives your team back 3 hours a week”.

4. Instead of “transforming finance”, try “turns tedious forms into two clicks”.

Notice what’s happening here?

You’re not devaluing things, you’re pinning meaning to reality. You’re giving the reader something to picture, feel or measure.

That’s how trust is built.

Some deeper psychology.

Jargon doesn’t just bore people. It also reduces credibility.

In a Princeton University study, researchers found that when students read unnecessarily complex writing, they rated the authors as less intelligent than those who used easier language.

The clearer you are, the more your audience believes you understand the subject. And if they trust your clarity, they’ll trust your product.

Don’t just avoid jargon because it’s uncool.

Avoid it because it makes you invisible and worse, untrustworthy.

So, next time you write a sentence that sounds like it should be in a fintech brochure, stop.

Ask yourself:

- Would a real customer say this?

- Could my competitor write this too?

- Am I solving a problem or describing a process?

If your answer makes you yawn, it’s probably jargon.

And if it’s jargon, it’s not helping you sell.

Speak soon

Leave a comment

Your email address will not be published.